At CIC we are committed to maintaining open and transparent communication with our shareholders and investors in order to nurture a strong relationship with them.

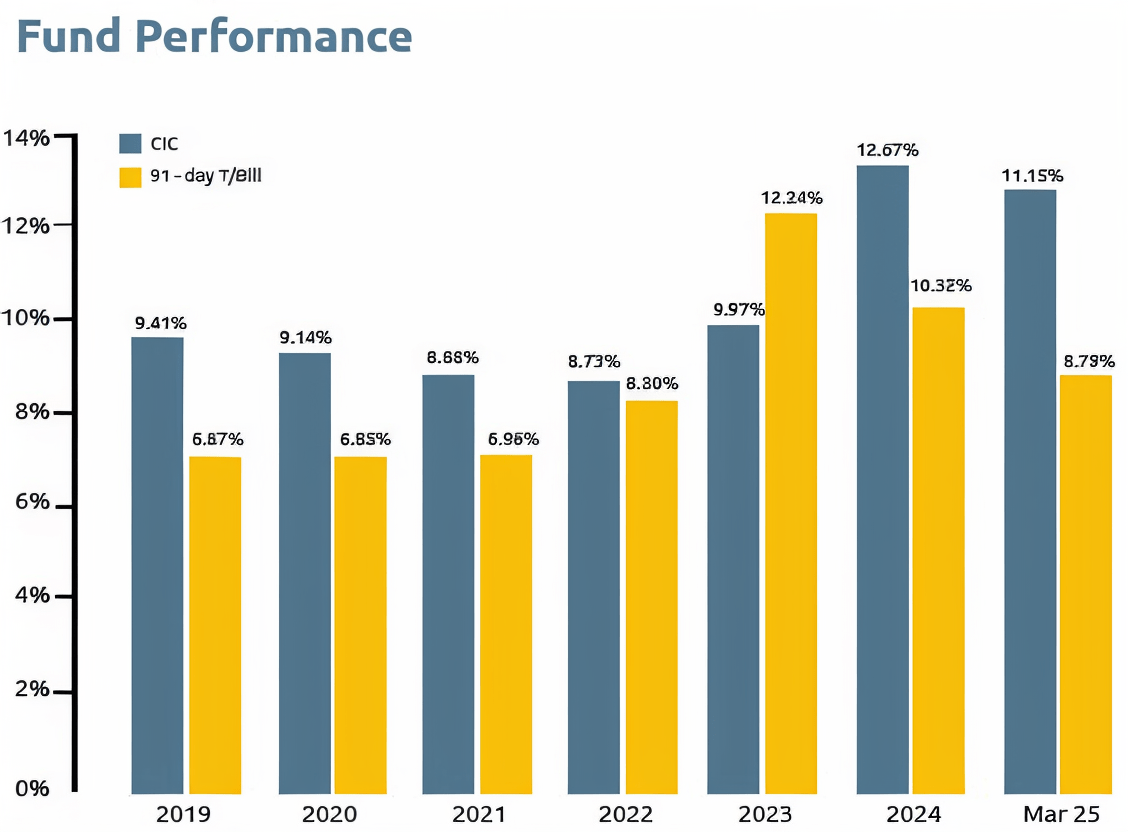

Fund Performace

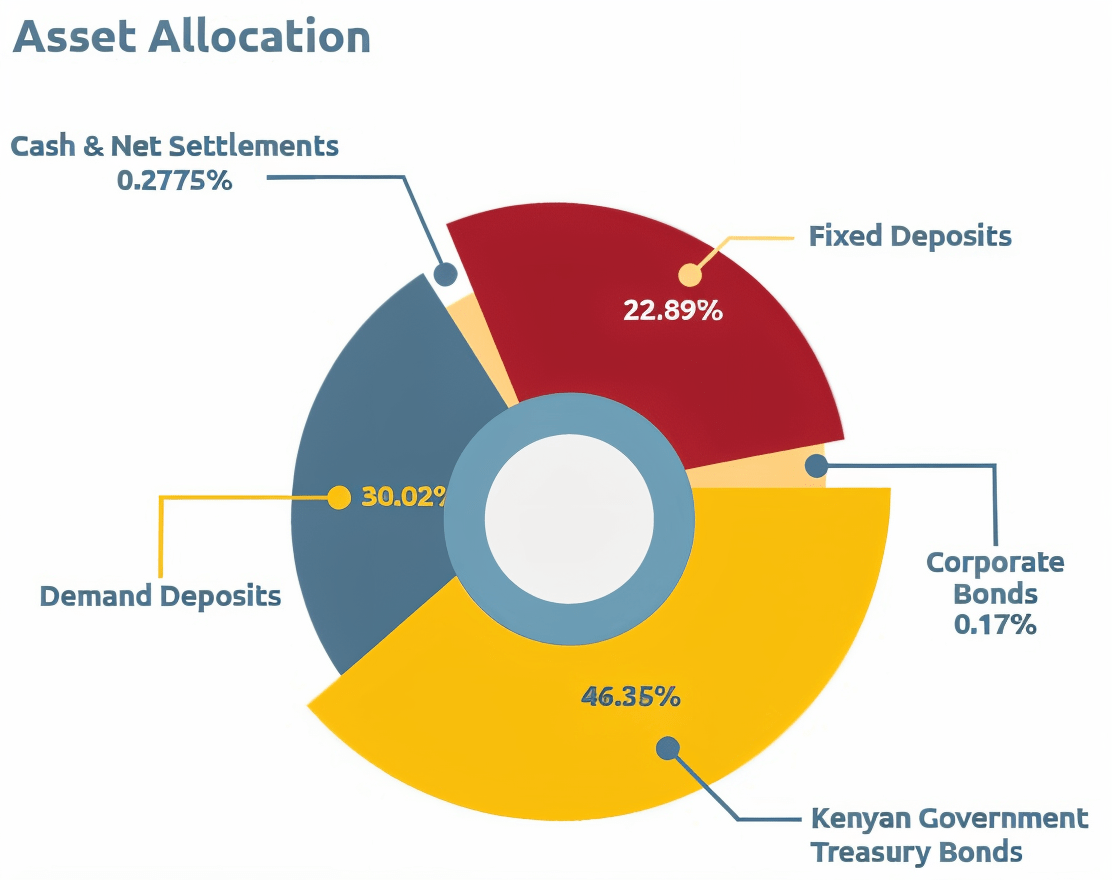

Asset Allocation

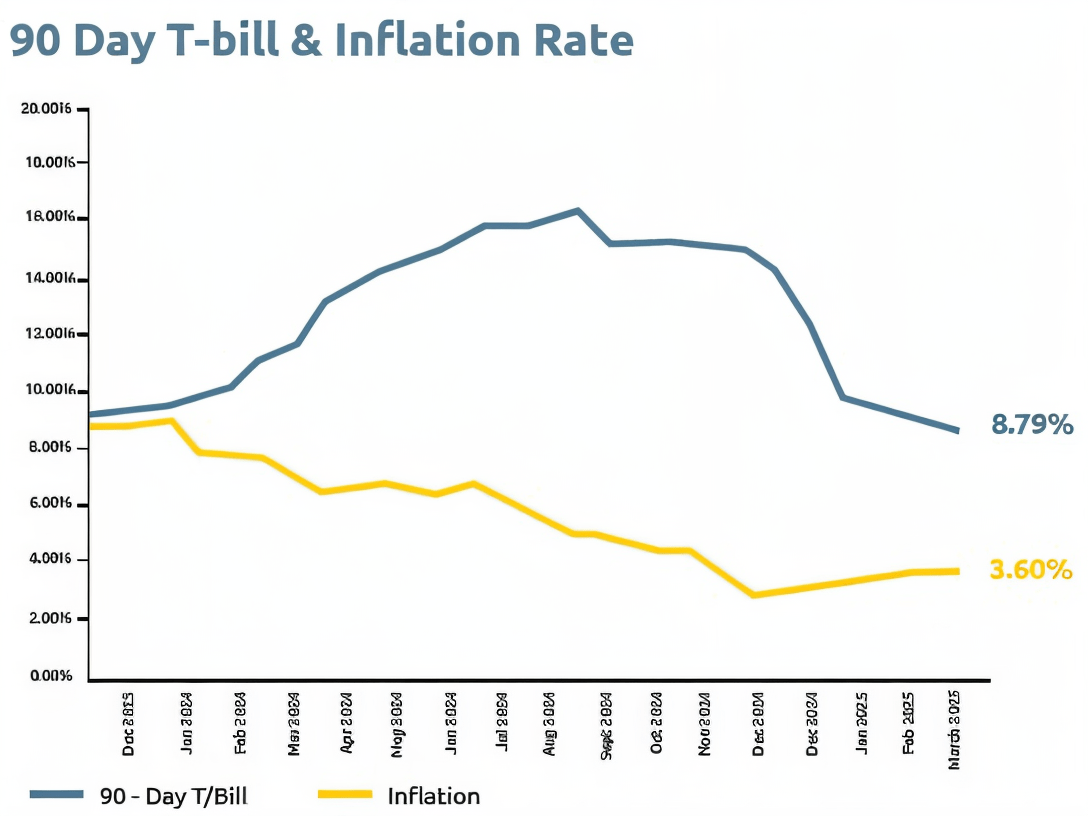

T- Bill Rates

Statutory Disclaimer: The value of units may go down as well as up and past performance is not necessarily a guide to the future. There are no guarantees on the client’s capital as the performance of units in the fund is determined by changes in the value of underlying investments hence value of your unit trust investment.