At CIC we are committed to maintaining open and transparent communication with our shareholders and investors in order to nurture a strong relationship with them.

Market Commentary

Key Features

|

Fund Manager |

CIC Asset Management Ltd |

|

Launch Date |

Jun – 11 |

|

Risk Profile |

Moderate |

|

Trustee |

Kenya Commercial Bank |

|

Custodian |

Co-op Custodial Services |

|

Auditors |

PWC |

|

Minimum Investment |

Ksh 5,000.00 |

|

Minimum Additional Investment |

Ksh 1,000.00 |

|

Initial Fee |

2.25% |

|

Annual Management Fee |

2.00% |

|

Distribution |

Quarterly |

|

Asset under Management |

KES 256.2 Million |

Who should invest?

Investors who are seeking ;

- Typically ready to invest over the medium to long-term.

- Need extra returns at moderate risk.

- Seek to benefit from a well-diversified portfolio of market instruments.

Fund Outlook

The fund continues to be conservative, being overweight short-term near cash assets while taking advantage of any entry opportunities following the recovery in the equity market due to the impact of full year earnings releases and currency appreciation which should to weigh positively on market prices.

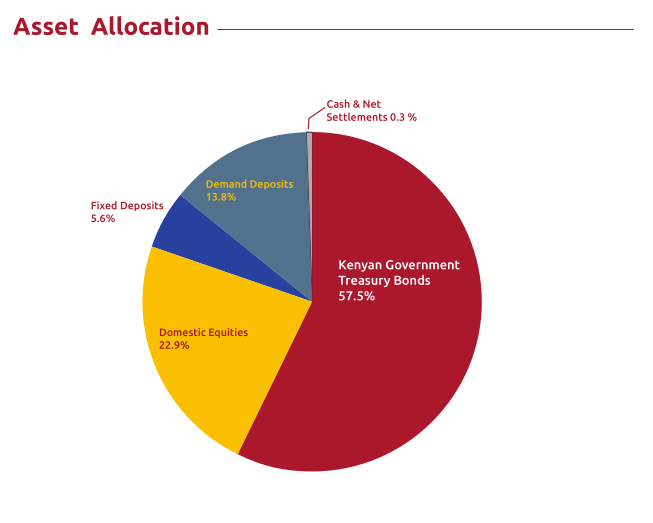

Asset Allocation

GDP

Real GDP expanded by 5.0 per cent in 1Q24 compared to 5.3% in 1Q23 (vs 5.5% in 4Q23). The positive growth was primarily notable in the

Agriculture sector +6.1%y/y on increased tea, milk, sugarcane production, though weighed by lower coffee and flower exports. Notable growth was also noted in real estate +6.6%y/y, financial and insurance services +7.0%y/y, ICT +7.8%y/y, accommodation and food services +28.0%y/y.

Inflation

Inflation decelerated, hitting a near 4-year low, due to slower growth in food and fuel prices. June inflation print came in at 4.6% compared to a restated 5.0% in May. 1H24 inflation averaged 5.6% vs 8.5% in 1H23. We anticipate the annual inflation rate to oscillate within the mid-point (5.0%) of CBK’s target range supported by the declining food and fuel inflation.

Interest Rates

Relative price stability combined with fairly decent economic growth prospects prompted the MPC to retain the Central bank rate at 13%. The increase in short-term papers has been somewhat moderate, with the 91, 182 and 365 day papers closing the first half of the 2024 at 15.98%, 16.76% and 16.79% respectively.

Equities

The bourse pared down 3.1% in June 2024, though closed the first half of 2024 in the green, +18.9% vs –16.1% in 1H23. Similarly, the N10, NSE 20 and NSE 25 gained 23.1%, 10.3% and 20.2% respectively. The fund will continue to ensure steady returns while taking moderate risk.

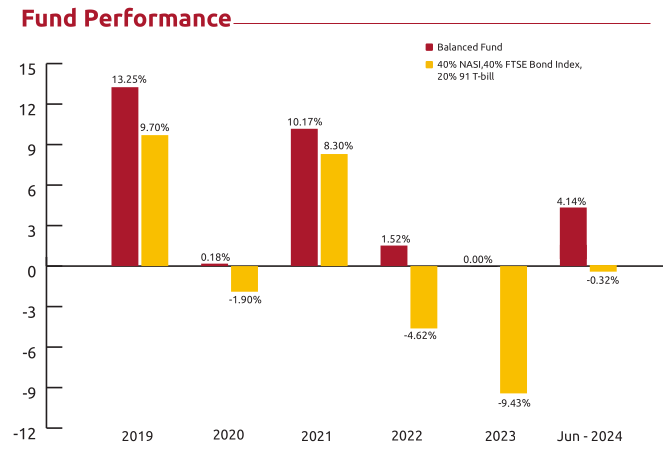

Fund Performance

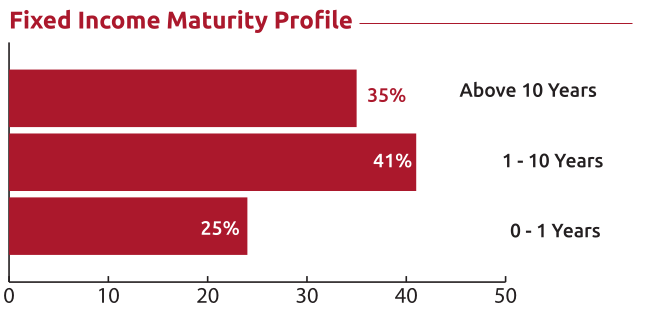

Fixed Income Maturity Profile

Statutory Disclaimer: The value of units may go down as well as up and past performance is not necessarily a guide to the future. There are no guarantee on the client’s capital as the performance of units in the fund is determined by change in the value of underlying investments hence value of your unit trust investment