At CIC we are committed to maintaining open and transparent communication with our shareholders and investors in order to nurture a strong relationship with them.

Market Commentary

Key Features

Fund Manager | CIC Asset Management Ltd |

Launch Date | Nov - 20 |

Risk Profile | Low |

Trustee | Kenya Commercial Bank |

Custodian | Co-op Custodial Services |

Auditors | PWC |

Minimum Investment | USD 1000.00 |

Minimum Additional Investment | USD 100.00 |

Initial Fee | Nil |

Annual Management Fee | 1.5% |

Distribution | Monthly |

Assets Under Management | USD 31.2 Million |

Fund Objective

Investors who are seeking ;

- Capital preservation whilst not seeking long-term capital growth.

- A high degree of capital stability and with a risk neutral appetite.

- Currency diversification.

Key Benefits

- Liquidity: The client is able to withdraw their funds at short notice with no penalty fees.

- Flexibility: The client is able to switch or transfer funds to another fund that he/she may have with CICAM.

- Security: The fund invests in government paper and liquid instruments.

- Competitive Returns: Interest is calculated daily and credited at the end of each month. As an institutional client, the fund benefits from placing deposits in large sums and as such is able to negotiate for competitive rates.

- Professional fund management: prospective investors benefit from the expertise of our seasoned professionals.

Outlook

The Kenyan shilling has stayed steady against the dollar. Even as US Interest rates continue to decline the fund is well positioned to Lock in attractive longer term rates.

GDP

Global headline inflation is excepted to abate to 4.2 % in 2025 and 3.5 % in 2026, with advanced economies reaching their targets sooner than emerging market and developing economies. This has roused a series of rate cuts across major global economies. However, we remain cognizant of the potential inflationary effects of tariffs resulting from the new US trade policies.

Inflation

Global headline inflation is excepted to abate to 4.2 % in 2025 and 3.5 % in 2026, with advanced economies reaching their targets sooner than emerging market and developing economies. This has roused a series of rate cuts across major global economies. However, we remain cognizant of the potential inflationary effects of tariffs resulting from the new US trade policies.

Exchange Rates

The shilling has remained stable against the dollar during the month of March to close at 129.3. The local foreign exchange re-serves propped up to USD 9.956 million (5.1 months of import cover). This meets the CBK’s statutory requirement to strive to uphold at least 4 months of import cover.

Interest Rates

The Fed left the federal funds rate unchanged at 4.25%-4.5% during its March 2025 meeting, maintaining the pause in its rate-cut cycle that started in January, as expected. Policymakers acknowledged that uncer-tainty about the economic outlook has grown but still anticipate an ease in interest rates by approximately 50 bps this year, consistent with their Decem-ber Forecast. Amidst the escalating geopolitical tensions and newly imposed US trade tariffs the economic landscape poses as both stable and wildly uncertain.

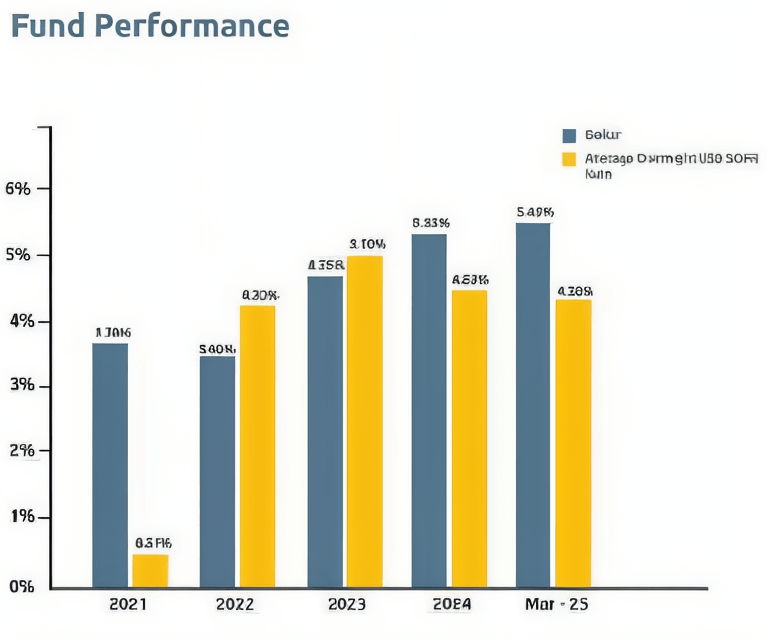

Fund Performance

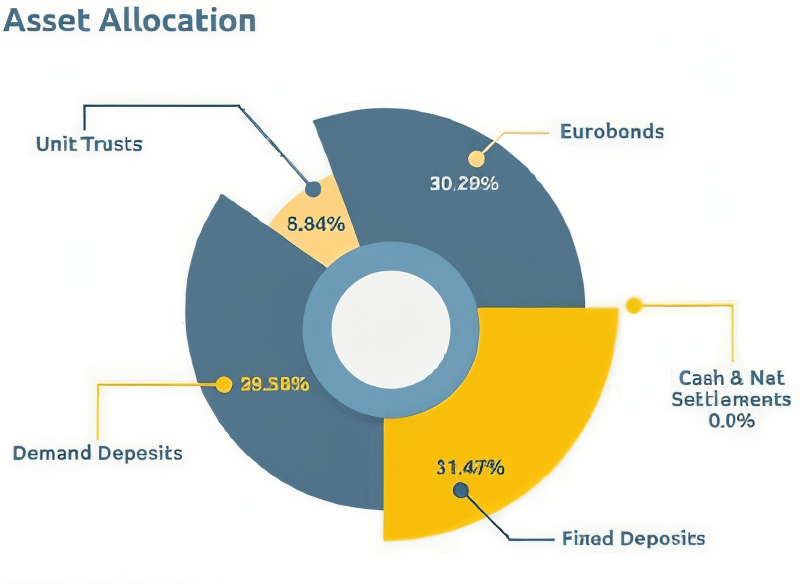

Asset Allocation

Statutory Disclaimer: The value of units may go down as well as up and past performance is not necessarily a guide to the Future. There are no guarantees on the client’s capital as the performance of units in the fund is determined by changes in the value or underlying investments hence value of your unit trust investment, Effective annual yield is presented net of fees and gross of withholding tax