At CIC we are committed to maintaining open and transparent communication with our shareholders and investors in order to nurture a strong relationship with them.

Market Commentary

Key Features

|

Fund Manager |

CIC Asset Management Ltd |

|

Launch Date |

Jun – 11 |

|

Risk Profile |

Moderate |

|

Trustee |

Kenya Commercial Bank |

|

Custodian |

Co-op Custodial Services |

|

Auditors |

PWC |

|

Minimum Investment |

Ksh 5,000.00 |

|

Minimum Additional Investment |

Ksh 1,000.00 |

|

Initial Fee |

2.25% |

|

Annual Management Fee |

2.00% |

|

Distribution |

Quarterly |

|

Assets Under Management |

310.1 Million |

Who should invest?

Investors who are seeking ;

- Typically ready to invest over the medium to long-term.

- Need extra returns at moderate risk.

- Seek to benefit from a well-diversified portfolio of market instruments.

Fund Outlook

The fund continues to be conservative, being overweight short-term

near cash assets while taking advantage of any entry opportunities following the

recovery in the equities market due to the impact of earnings releases, corporate

announce-ments and currency appreciation which should continue to weigh

positively on market prices.

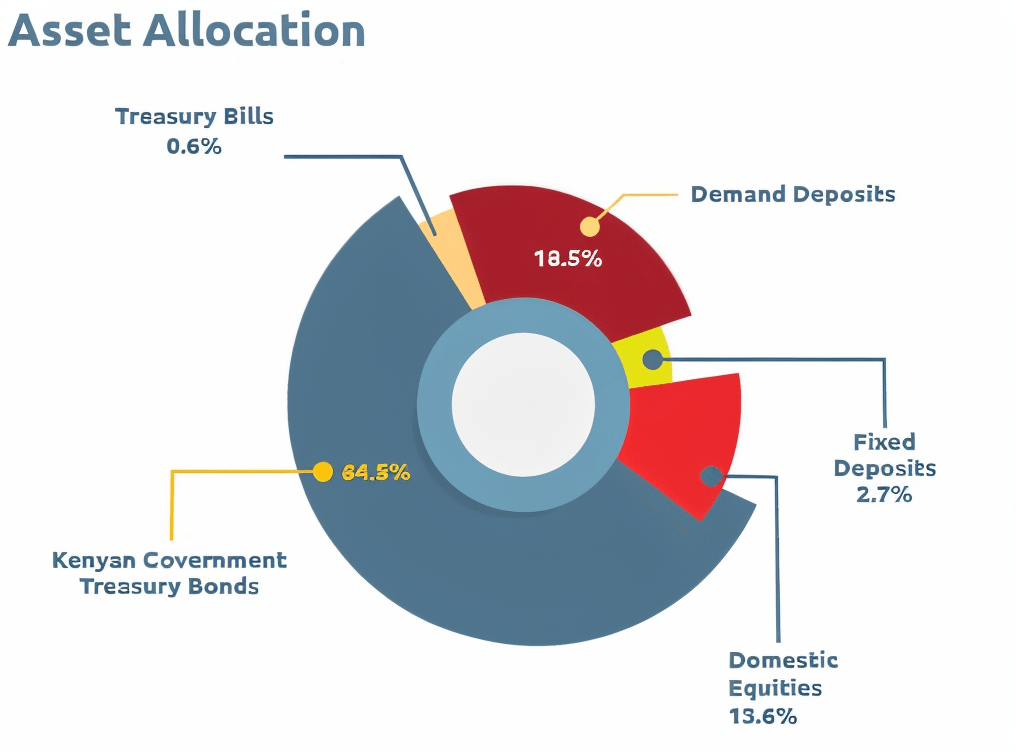

Asset Allocation

GDP

Kenya’s economy expanded by 4.0% in the third quarter of 2024, a decline from a 6.0% growth in the same quarter 2023. The slowdown was largely caused by contraction in critical sectors-Construction, Mining and Quarry-ing. However, the slower GDP growth observed in Q3 2024 was bolstered by strong performance in specific sectors (agriculture, accommodation services, and transportation) despite overall economic deceleration compared to previous years.

Inflation

Headline inflation edged up to 3.6% in March 2025 from 3.5% in Feb 2025, largely on account of increase in prices of food and non-alcoholic beverages. Food inflation increased to 6.6% from 6.1% in Feb 2025 predominantly owing to the rise of vegetables and maize flour prices. Core inflation, stood at 2.2 % in March 2025, a rise from 1.9% in Feb 2025 while non-core to 7.4% from 7.1% over the same period

Interest Rates

In February, the Monetary Policy Committee voted to lower the policy rate to 10.75% from 11.25% having reviewed the out-comes of its previous decisions to anchor inflationary expectations and maintain exchange rate stability. The short-term papers continue to record a decline, with the 91-, 182- and 365-day papers closing at 8.79%, 9.06% and 10.41% respectively.

Equities

In the month of March the bourse finished in the red on account of a plunge in the market capitalization which stood at KES 2,056Bn (-1.0m/m, 16.4% y/y). This was coupled by a waning market activity as depicted by the slump in Key indices, NASI, NSE-20 and NSE-25. The latter shed –1.0%, 3.19% and 1.74% respectively to close at 130.81, 2226.88 and 3532.38.

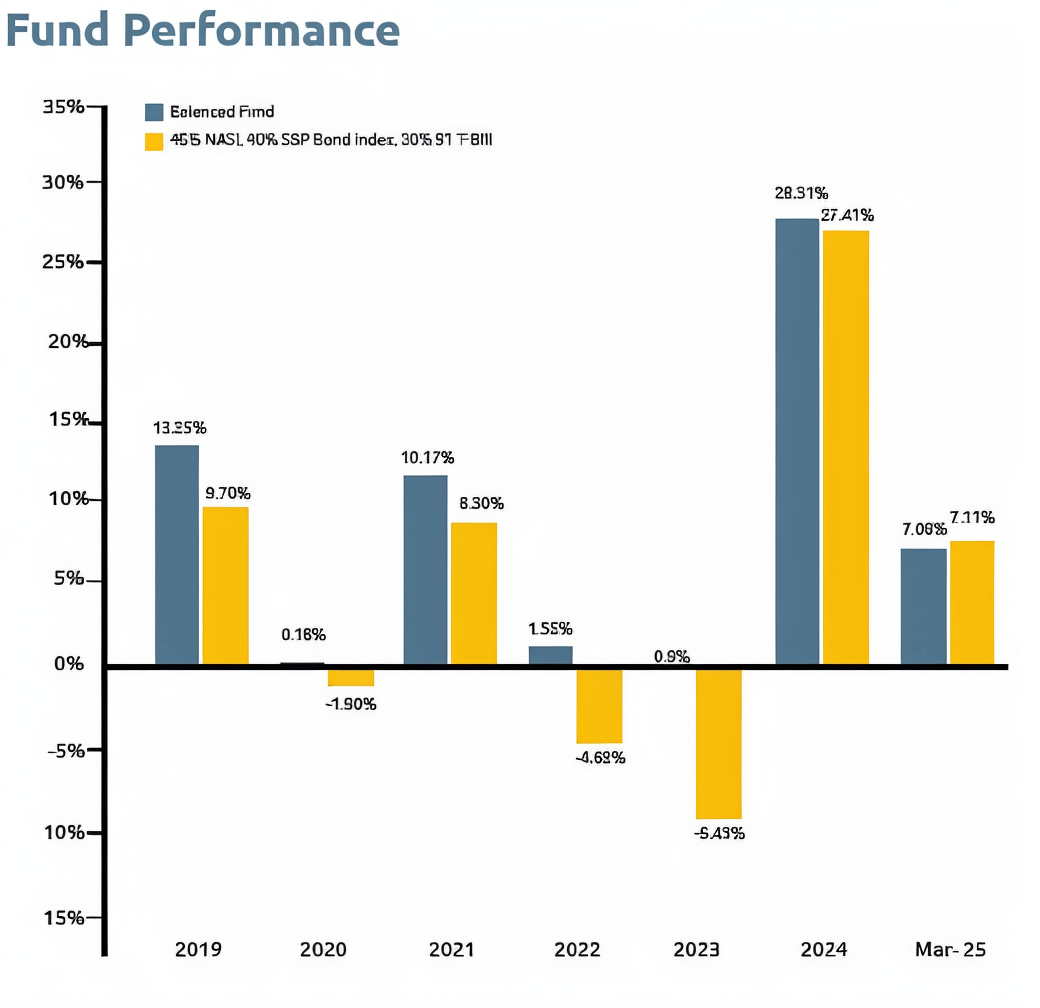

Fund Performance

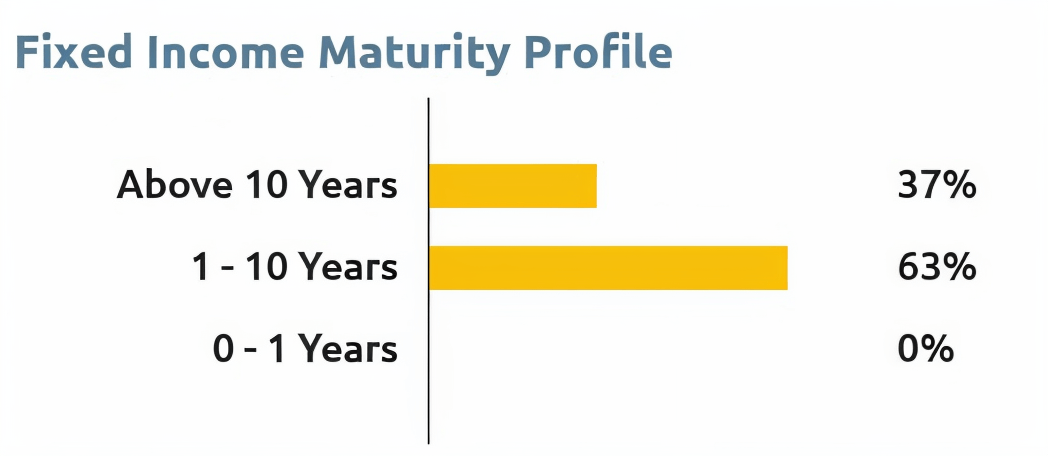

Fixed Income Maturity Profile

Statutory Disclaimer: The value of units may go down as well as up and past performance is not necessarily a guide to the future. There are no guarantees on the client’s capital as the performance of units in the fund is determined by changes in the value of underlying investments hence value of your unit trust investment. Effective annual yield is presented net of fees

and gross of withholding tax.